Small Business: the Fabric of our Community

As a Fibre Artisan ( someone who works with fibre – spinning, knitting, crocheting and a little weaving) attending the Town Hall on Wednesday Mar 3rd it was interesting to hear numerous businesses speak my language!

Many times the phrase “ Small Business is the Fabric of our Community” was used.

If we look at our community as a fabric, or tapestry what do

people see?

Are we fraying at the edges?

I would say yes

we are. Our Local Businesses are struggling

and COVID is the latest attack.

Sales

are down: by as much as 65%

Employment is down; many businesses

have had to make the heartbreaking decision to reduce staff.

Bills still need to be paid! Some businesses are also facing rent

increases on top of their normal rates…as if using your personal savings was

not enough most business owners stopped taking a salary.

Many

who sponsored/donated to local groups/events are no longer able

The edges are fraying, the fabric is thinning and the

colours are fading but the picture is still there! Small business is part of our town culture, a support

system for the town and we need to find ways to repair or rejunivnate the fabric!

What would you suggest?

Shop Local – Support Local is already an initiative that has been promoted at all levels of business and government.

Promote one another! If you know of someone who is looking for a service or store, promote local first!

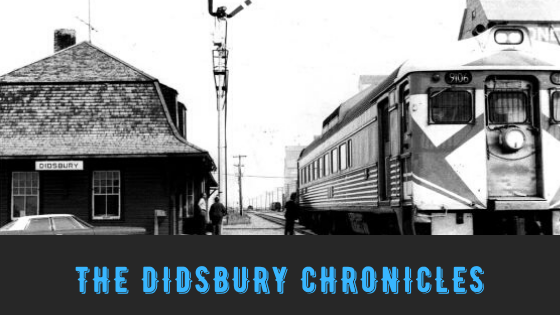

Be positive! We live in Didsbury because we want to be here, so let everyone know what a great community we offer.

Lead! Show that we are following all protocols to stay safe. This is a safe place to come and live, shop, or run your business.

Our fabric may be in need of some TLC and repair, but we are

not beyond repair! Lets see how we can

pick up those loose threads, darn those holes and be ready to hang for another

100 years showing off our colours!

What else would you suggest?